I don’t have unlimited reserves of cash that I can use to invest in UK shares. But here’s a collection of top FTSE 100 dividend stocks and investment trusts I’d like to buy in 2023.

I think they could be great sources of long-term passive income.

St James’s Place

People are more active than ever before when it comes to financial planning. Years of poor returns from traditional savings products means demand for investment managers like St James’s Place (LSE: STJ) is rising strongly.

Growing fears over the future of the State Pension are also encouraging people to become savvier with their money. St James’s Place says there are 12m potential customers in the UK, around half of whom are yet to seek advice. This provides a huge amount of business for it to win.

Of course the business operates in a highly competitive marketplace. But it’s steadily expanding to exploit its huge market opportunity. It had 4,626 advisers on its books as of last June, an increase of 70 from the start of the year.

Today it offers a healthy 4.8% dividend yield. The business had a strong record of annual payout growth leading up to the pandemic. And City brokers expect dividends to increase strongly this year and next as profits continue improving.

abrdn European Logistics Income

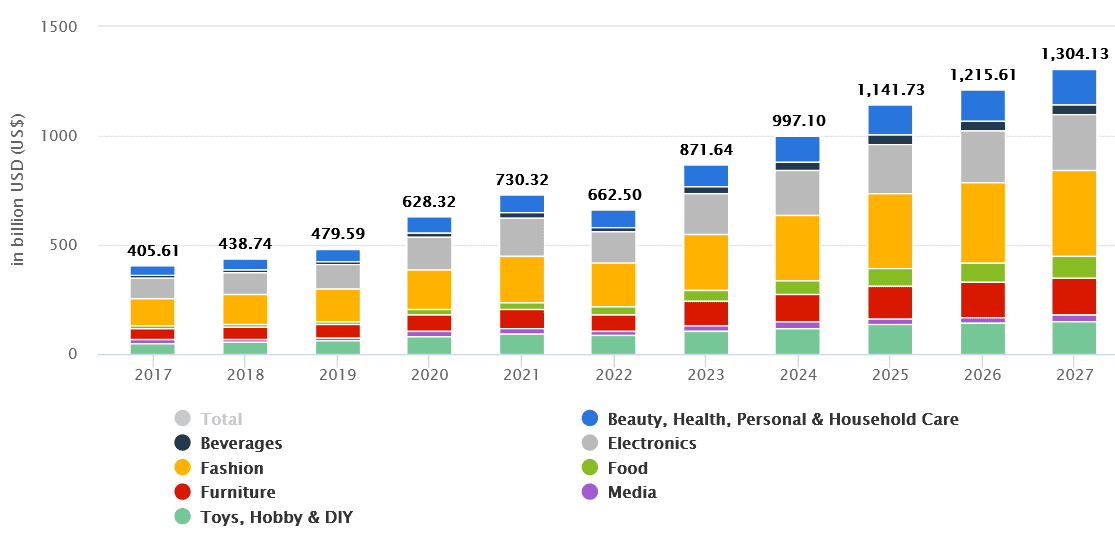

As the chart below shows, e-commerce is tipped to grow strongly in Europe over the short-to-medium term. So I’m considering buying abrdn European Logistics Income (LSE: ASLI) shares for my portfolio.

This investment trust owns a growing portfolio of warehouses and distribution hubs in mainland Europe. Such assets play a crucial role in getting products from manufacturer and retailer to the consumer. Yet supply is failing to keep up with demand, meaning rents continue to rise strongly.

High construction costs could impact the company’s bottom line in the nearer term. But on balance I think property shares like this are great ways to protect oneself against inflationary pressures. This is because operators can effectively raise rents to pass on rising operating costs.

The forward dividend yield at abrdn European Logistics Income sits at 6.2%.

Vodafone Group

Huge uncertainty surrounds Vodafone Group (LSE: VOD) following chief executive Nick Read’s decision to step down. There will be no shortage of experienced candidates for the job. But a likely change in direction always creates risks for investors.

Despite this, I still believe the FTSE 100 firm is an attractive stock to own. As the world becomes more digital, telecoms companies have an increasingly important role to play in our day-to-day lives. This could lay the groundwork for strong long-term earnings growth.

I like Vodafone specifically because of its operations that straddle Europe and Africa. This gives it exposure to both stable/mature and fast-growing markets. I’m also excited by the huge investment the company is making in 5G and ultrafast broadband, two white hot growth areas.

The telecoms firm carries a huge 10.1% forward dividend yield today. I think it’s a great share to help me boost my passive income.